In the ever-evolving landscape of financial markets, the year 2024 has brought about a remarkable resurgence in the world of cryptocurrencies, with Bitcoin leading the charge to reach new highs. As the digital assets gain mainstream acceptance, investors and enthusiasts are left questioning the driving forces behind this surge and what the future holds for the decentralized revolution.

Another crypto wave?

Bitcoin, the pioneer of cryptocurrencies, has once again captured the spotlight by reaching unprecedented price levels. At the time of writing, Bitcoin has surpassed its previous 52 Week (Year to Year) high, a feat that has both seasoned investors and newcomers buzzing with excitement. The BTC is on track to possibly reach its all time high, too.

Several factors contribute to this surge, reflecting the maturation and growing acceptance of cryptocurrencies in various sectors.

- Institutional Adoption: One significant catalyst for the current bull run is the increased institutional adoption of Bitcoin. Major financial institutions and corporations have begun to recognize the value of adding Bitcoin to their portfolios as a hedge against inflation and a store of value. This institutional endorsement not only lends legitimacy to the cryptocurrency but also provides a sense of security to potential investors.

- Global Economic Uncertainty: The ongoing global economic uncertainties, fueled by geopolitical tensions, inflation concerns, and the impact of the COVID-19 pandemic, have led investors to seek alternative assets. Bitcoin, with its decentralized nature and finite supply, is increasingly viewed as a safe-haven asset, akin to gold, offering a hedge against traditional market fluctuations.

- Technological Advancements: Continuous improvements in the underlying technology of cryptocurrencies have also played a pivotal role. Upgrades like the Lightning Network for Bitcoin have enhanced transaction speed and reduced fees, making cryptocurrencies more practical for everyday use and further solidifying their place in the financial landscape.

- Mainstream Acceptance: The acceptance of cryptocurrencies by mainstream entities and businesses has reached unprecedented levels. From major retailers accepting Bitcoin payments to countries exploring the creation of central bank digital currencies (CBDCs), the narrative around cryptocurrencies has shifted from skepticism to integration. Even TESLA, the electric vehicle (EV) car maker, accepts the altcoin "Dogecoin" for payments.

Other crypto currencies riding the wave

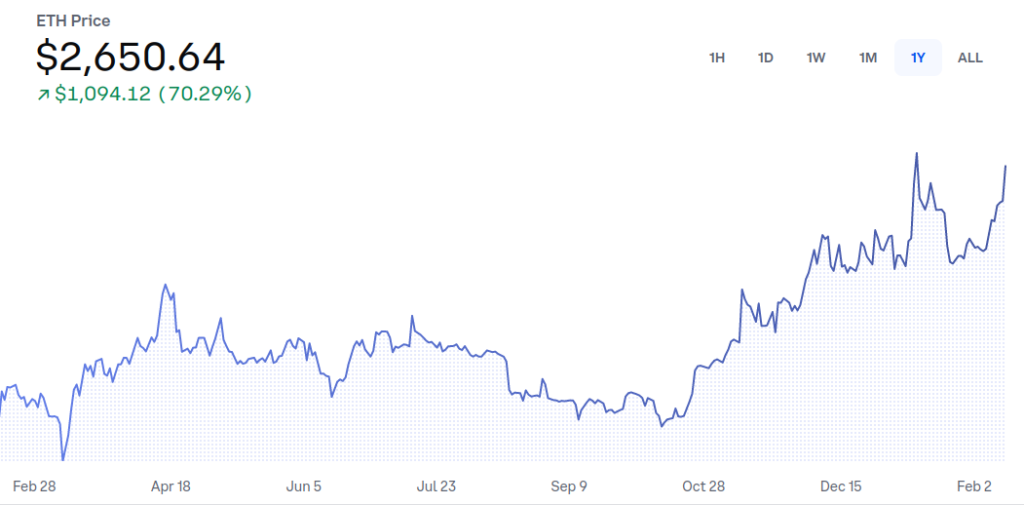

While Bitcoin's resurgence takes center stage, other crypto currencies, collectively known as altcoins, are also experiencing significant price surges. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is breaking Year-to-Year records as its utility in decentralized finance (DeFi) and non-fungible tokens (NFTs) continues to expand. This broader acceptance and utilization of various cryptocurrencies contribute to the overall bullish sentiment in the market.

Where to from here?

As the cryptocurrency market continues to mature, questions linger about its sustainability and potential regulatory challenges. The volatile nature of cryptocurrencies means that prices can experience sharp corrections as well as surges. However, the increasing adoption, technological advancements, and institutional interest suggest that the overall trajectory is positive.

The current peak in the prices of Bitcoin and other cryptocurrencies signifies a pivotal moment in the evolution of digital assets. From being viewed as speculative ventures to emerging as legitimate investment options, cryptocurrencies are reshaping the financial landscape. As the industry navigates regulatory frameworks and further integrates with traditional financial systems, the future of cryptocurrencies looks promising, with potential for continued growth and mainstream acceptance.